Property Tax Mission Statement

The mission of the Property Tax Division is to manage property tax revenue in accordance with statutory regulations while providing taxpayers and taxing entities with excellent customer service, precise allocations and effective reporting.

Property Tax Vision Statement

Be a model for local governance with innovative, competent and responsible public servants committed to providing quality service.

Property Tax Responsibilities

The Property Tax Division of the Auditor-Controller’s Office handles a wide variety of Property Tax related issues for the County of Riverside.

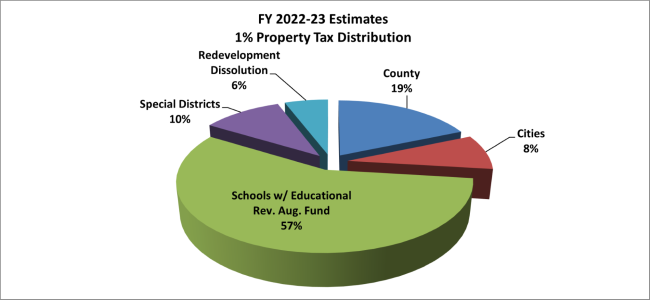

More than $4.5 Billion annually gets apportioned (distributed) to approximately 350 participants, including cities, K-14 schools and special districts.

- Prepare and levy tax bills for Secured, Unsecured and Supplemental property within Riverside County.

- Prepare various State reports.

- Allocation of Property Tax Revenue to the County, Cities, School Districts and Redevelopment Agencies in accordance with State mandates.

- Process Tax Bill/Tax Roll corrections and changes issued by the County Assessor, various taxing authorities, and the County Tax Collector.

Image

Property Tax Statistics

173,566 Supplemental Bill Count

955,282 Secured Roll Bill Count

37,136 Unsecured Roll Bill Count

36,881 Roll Corrections

37,786 Refunds

2,478 Fixed Charge Funds

40 Tax Apportionments